If you’ve ever had to share your favorite dessert with someone, the concept of dilution is probably already etched into your memory. Essentially, dilution refers to the decrease of a shareholder’s ownership percentage in a company due to an increase in the number of outstanding shares. (This increase in shares necessarily reduces the shareholder's ownership in the company since they now hold a smaller piece of the corporate pie.) Because nobody likes ending up with a smaller piece of pie than they originally anticipated, anti-dilution provisions were established to protect investors from having their ownership in the company diluted during a less-than-favorable financing.

What Is an Anti Dilution provision?

Anti-dilution is a provision that is often negotiated by investors as a protection against dilution in a company should there be a "down round" (ie. the price of stock decreases in a subsequent financing). Anti-dilution provisions don’t create any new shares; they change the conversion price of existing stock classes (which matters when you exit!). If your Series A investors bought in at $10 a share for 10% of the company, they don’t want to see the Series B investors get 10% of the company for $5 a share. So, Series A investors will get a new conversion price for their shares that makes each of their shares convert into more than 1 share of common at exit.

This post will explore three different options when it comes to setting the anti-dilution provision for a stock class: full ratchet, no price based anti-dilution protection, and weighted average anti-dilution protection.

Full ratchet anti-dilution simply means that the conversion price of existing preferred stock is reduced to the price at which the new shares are issued in the subsequent round. In other words, if the Series A investor purchased shares at $1 each and the Series B round prices each share at $0.5, the Series A shares conversion price will be reduced to $0.5 per share (or 2 common shares per each Series A share).

No price-based anti-dilution, on the other hand, means that the preferred investor will not be protected against a down round any more than the common stockholders. While many common stockholders think that this is the fairest option, many preferred investors will not agree to take the down round risk without any anti-dilution protection. Investors who do agree to no price-based anti dilution may often have another agreement which provides them with additional shares upon a down round, although in some cases investors will have no anti-dilution protection at all.

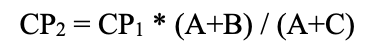

Weighted average anti-dilution attempts to find an intermediate point between the existing conversion price of the existing round and the conversion price of the new round. The NVCA term sheet provides the following formula for finding the weighted average:

Where:

- CP2 = Series A Conversion Price in effect immediately after new issue

- CP1 = Series A Conversion Price in effect immediately prior to new issue

- A = Number of shares of Common Stock deemed to be outstanding immediately prior to new issue (includes all shares of outstanding common stock, all shares of outstanding preferred stock on an as-converted basis, and all outstanding options on an as-exercised basis; and does not include any convertible securities converting into this round of financing)

- B = The number of shares that would have been issued in the new transaction if the issue price were CP1

- C = The actual number of shares issued in the new transaction.

There are three ways to define A, and these methodologies determine how aggressively the conversion price will be adjusted. Narrow-based anti-dilution weighted average includes only currently outstanding (not fully diluted) securities. Broad-based anti-dilution weighted average includes the currently outstanding securities and granted options. And broadest-based anti-dilution weighted average includes currently outstanding securities, granted options, and the ungranted pool. The broader (or larger) your A number is, the less impact there will be on the conversion price.

Keeping track of anti-dilution implications when modeling a new round, or recording these changes after the closing has completed, can be quite complex. Fidelity makes anti-dilution a piece of cake by baking it into the platform and allowing users to specify the precise type of anti-dilution which is applicable to their preferred stock for each financing. Instead of endless hours in spreadsheets and second-guessing, Fidelity keeps track of conversion calculations so that they are as simple as the press of a button. Have more questions about equity management calculations? We're happy to chat.

Third party mentioned and Fidelity are not affiliated.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.